Paye hourly rate calculator

PAYE of Thresholds. For all other areas of the UK please use the UK Salary Calculator.

1

Claim an unemployment repayment.

. New Tax Law Amendment Bill 2020 PAYE tax rates. If your salary is 60000 then after tax and national insurance you will be left with 43257. If you earn 20000 a year then after your taxes and national insurance you will take home 17529 a year or 1461 per month as a net salary.

Income up to 14000. 228 per week 988 per month 11850 per year. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to.

PAYE tax rates and thresholds 2018 to 2019. Use our PAYE umbrella calculator above to quickly find out based on your hourly or daily rate. Review your tax for a previous year - PAYE customers.

Online since 1999 we publish thousands of articles guides analysis and expert commentary together with our. Based on a 40 hours work-week your hourly rate will be 1923 with your. The Employment Act 229 Laws of Kenya gives the minimum hourly rate at Monthly Salary225 However this formula acts mainly as a guide and assumes a 52 hour work-week.

Work out backwards from a given net pay. 240 per week 1042 per month 12500 per year. Total Tax Deducted 000.

English and Northern Irish basic tax rate. Most private student loan companies offer five- seven- 10- and 15-year terms but some also provide 20- or even 25-year terms. Scottish starter tax rate.

UK PAYE Tax Calculator 2022 2023. Its worth bearing in mind that all umbrella companies have to abide by the same HMRC rules regarding tax so regardless of what their umbrella take home pay calculator says the only difference in take home pay is down to the margin they retain. Wingubox Payroll provides a more realistic approach based on international best-practice as below.

Employment income is subject to employees NICs and income tax deducted via PAYE. If you earn 25000 a year then after your taxes and national insurance you will take home 20867 a year or 1739 per month as a net salary. If you earn 40000 a year then after your taxes and national insurance you will take home 30879 a year or 2573 per month as a net salary.

Online Payroll Software Free Trial. 25000 Salary Take Home Pay. Calculate your KRA NHIF NSSF Old and new rates and net pay.

19 on annual earnings above the PAYE tax. The results are broken down into yearly monthly weekly daily and hourly wages. If your salary is 65000 then after tax and national insurance you will be left with 46094This means that after tax you will take home 3841 every month or 886 per week 17720 per day and your hourly rate will be 3125 if youre working 40 hoursweek.

Contractor Calculator the UKs authority on contracting serves a readership of over 200000 visitors per month see latest traffic report made up of contractors from IT telecoms engineering oil gas energy and other sectors. View your pay and tax. Effective payroll tax rate.

Private Student Loans. The exact plan you choose will depend on the. Hourly rate and daily rate calculator.

File an Income Tax Return. Create a summary of your pay and tax details. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

Holiday Pay Rate Add percentage based payrise. Select a specific online salary sacrifice calculator from the list below to calculate your annual gross salary after salary sacrifice adjustment and net take home pay after deductions. Simply enter your current gross annual salary and your personal tax code to calculate your tax liability.

Free Online payroll PAYE calculator for Kenya. Spanning PAYE Class 1 CIS and Self Employed Class 2 and Class 4 types. New Zealands Best PAYE Calculator.

Our tax calculator uses tax information from the tax year 2014 2015 to show you take-home pay if you need to see details of PAYE and NI for a different year please use our advanced options. Based on a 40 hours work-week your hourly rate will be 843 with your 20000 salary. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Scroll down to see more details about your 65000 salary Income Income Period. Service Gratuity Calculator. Based on a 40 hours work-week your hourly rate will be 1203 with your.

Ie it is based on you contributing 40 of your basic pay every month rather. Our PAYE calculator shows you in seconds. If you wish to calculate your income tax in Scotland before the income tax rate change in 201718 you can use the pre 201718 Scottish Income Tax Calculator.

Add a job or a pension. Manage your tax for the current year - PAYE customers. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

Contractor Calculator the UKs authority on contracting serves a readership of over 200000 visitors per month see latest traffic report made up of. PAYE tax rates and thresholds 2020 to 2021. The simple NIPAYE calculator allows you to calculate PAYENI on the salary that you pay yourself out of your limited company.

This calculator assumes youre employed as being self-employed means hourly weekly fortnightly and monthly income payments will be different depending on when you make tax payments and how much you pay. Based on a 40 hours work-week your hourly rate will be 1325 with your 35000 salary. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to.

The calculator will automatically adjust and calculate any pension tax reliefs applicable. Enter the number of hours you do each month and the rate you get paid at - for example. The results are broken down into yearly monthly weekly daily and hourly wages.

Please note if your pension is a relief-at-source type of pension the tax deducted on your pay may be. Assuming that you are comparing the calculators results with 15 pension and 40 pension the reason youre seeing an apparent increase in take-home for your bonus month is that the calculator works out the tax for the whole year based on the options you enter. Calculate your take home pay from hourly wage or salary.

Get the hours per week Hours per day x Working daysper week. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. 40000 Salary Take Home Pay.

This Salary and PAYE calculator is purely for those subject to PAYE rules and regulation which falls under Scottish control. This means that after tax you will take home 3605 or 832 per week 16640 per day and your hourly rate will be 2080 if youre working 40 hoursweek. Each calculator provides the same analysis of pay but is simplified to allow you to enter your salary based on how you are used to being paid hourly daily etc.

If you earn 35000 a year then after your taxes and national insurance you will take home 27542 a year or 2295 per month as a net salary. Hourly Daily Rate Calculator. Basic Rate Tax at 20 is 000.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

At The End Of The Day How Much Does An Employee Cost Hourly Inc

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly Vs Salary Pros And Cons Quill Com Blog

How To Calculate Wages 14 Steps With Pictures Wikihow

How Much Rent Can I Afford On My Hourly Pay My First Apartment First Apartment Apartment Checklist First Apartment Checklist

1

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

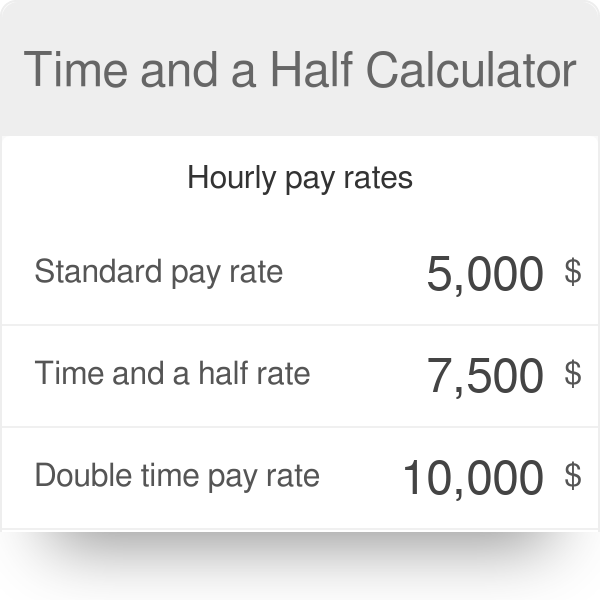

Time And A Half Calculator

Payslip Templates 28 Free Printable Excel Word Formats Templates Professional Templates Excel

Gross Pay

1

Hourly Rate Calculator Plan Projections Rate Calculator Saving Money

Mathematics For Work And Everyday Life

How To Invoice For Hourly Work